Tax Season: Like a Recital but with Paperwork

Charles Harris, CPA

MTNA Business Digest, Volume 5, Issue 2

January 2026

Tax season can be overwhelming—much like the first time you step foot on a stage to perform at a recital. Your nerves are everywhere, and you’re concerned about whether you can make the payments and if you know enough to file. With preparation and knowledge, I know you will be successful!

Tax season can be overwhelming—much like the first time you step foot on a stage to perform at a recital. Your nerves are everywhere, and you’re concerned about whether you can make the payments and if you know enough to file. With preparation and knowledge, I know you will be successful!

Gather Necessary Information

While taxes can cause anxiety, I want to help guide you with some simple strategies to make the season much easier.

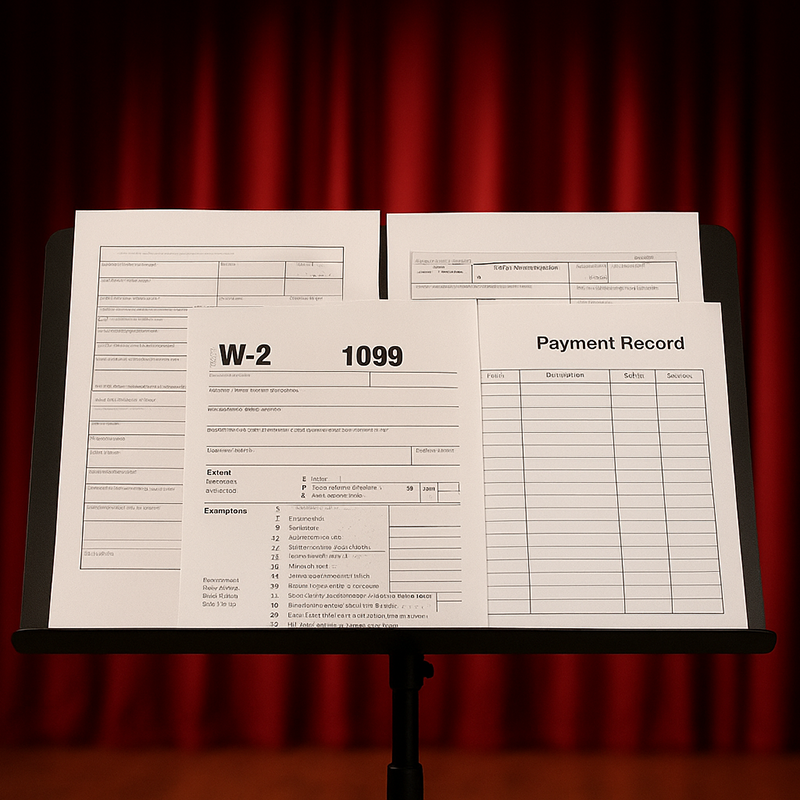

- Start now! Just like a recital, you can’t start practicing the week before and expect to play well; with taxes, you can’t wait until April 15. Make a list of everything you’ve needed in the past. If you teach independently, you may only need business transactions, but please think through all possibilities. The forms needed should include the following:

- W-2 (payroll forms for employees, if applicable)

- 1099-NEC (independent contractor forms, if applicable)

- 1099-INT (from your bank and/or investment accounts)

- Quarterly estimated tax payment records

- All business transactions

- Keep business expenses and personal expenses separate. If you haven’t kept them separate, record each transaction as personal or business. You should have a separate business bank account if you don’t already, and don’t mix personal expenses with business expenses. I always recommend having every receipt from the prior year. However, if you don’t, make sure your expenses line up with your business bank statements.

- Make sure you have a record of all your income. This includes all money earned from teaching, performing, and other sources of revenue. You should review all payment processors as well (like Venmo, CashApp, Paypal) and have a record of cash payments.

With this information in hand, we can fill out the required forms on your taxes.

Common Pitfalls and Missed Deductions

You’ve practiced and prepared your piece for weeks, but that doesn’t mean your performance will be flawless. Even armed with all this information, you can still encounter some common pitfalls. Let’s walk through a few common pitfalls that an independent studio or music school might specifically see.

While it might be nice to be able to deduct all expenses, only certain expenses actually count as a deduction. The IRS has drawn the line at “ordinary and necessary” for deductible business expenses. Sadly, this means that the friendly family dog greeter who is present for all lessons is not considered a deduction, and neither are the following commonly disallowed expenses:

- Clothing: Even recital clothing is not deductible, according to the IRS.

- Gas and Vehicle Expenses: Generally speaking, most filers deduct the driven mileage multiplied by the IRS mileage rate ($0.70 per mile for 2025) and don’t include gas and vehicle expenses.

- Credit Card Payments: While the expenses on the credit card are deductible, the payments on those credit cards are not deductible.

On the other hand, there’s a whole slew of things you can deduct that business owners often forget. Common missed deductions include:

- Conferences/Professional Development: MTNA conference expenses are deductible because they are improving your teaching ability. This includes registration fees and any hotel and travel expenses related to the conference.

- Home office deduction: This is missed because it’s a little more complicated to calculate. The simplified approach is $6 per sq. ft. in 2025. This approach can be used up to 300 sq. ft.

- Mileage: We talked earlier about not tracking gas and other vehicle expenses, but I do want you to track mileage. The mileage rate adds up very quickly, especially for teachers who travel to teach in their students’ homes. Mileage does not include “commute” so it depends what you can count. If you teach out of your home and travel to students, then every mile counts. If you only travel to students’ homes, you can’t include the first and last drive.

What’s New for 2025 Taxes?

Luckily for me, the new tax code hasn’t changed much with the One Big Beautiful Bill (OBBB), but I do want to mention keeping track of your charitable giving. Even if you take the standard deduction, a small amount of charity is still allowed this year. So, keep your receipts. This will be reported on page one of your 1040 tax return, right next to the standard deduction.

The OBBB also rescinded the change in threshold for issuing a 1099-K from payment platforms back to 2022 levels. This does not mean that any money paid to you via Venmo, CashApp, or similar services isn’t taxable. You just won’t receive a form letting you know the amount they paid out to you unless they paid out over $20,000.

If You Need Help

If you need additional help, reach out to a tax professional. We want to help ensure you are confident filing your taxes. It can be difficult to find the right tax accountant. There is a shortage of qualified professionals. Not every bookkeeper is competent or willing to file taxes.

I always recommend hiring a Certified Public Accountant (CPA) or Enrolled Agent (EA) professional because they have passed rigorous tests and have a minimum level of knowledge. What is most important is to find someone to help you file who is willing to talk with you in at least one meeting each year to explain your taxes.

Taxes come once a year, but you have to keep up with the paperwork year-round to make sure you are ready when tax season comes. There is much to remember when it comes to taxes, but I have the utmost confidence you can get them done.

Charles Harris is a CPA who works with music schools across the country. Having studied music growing up and in college, he loves helping music teachers with accounting and taxes. Connect with Charles at https://www.musicstudiostartup.com.